Protect Your Land

Learn About Your Options

As a property owner, you know that your land is special. Like many landowners, you are probably concerned about your land’s future. With increasing development pressure on natural land, many property owners ask themselves:

“What will happen to my land? Will future owners care about my land the way I do? Will my children and grandchildren be able to afford to keep my land?”

Since its founding in 1974, the Cedar Lakes Conservation Foundation (CLCF) has partnered with property owners to conserve over 3,200 acres of land in our mission area within the Cedar Lakes region. CLCF envisions a future landscape that maintains a balance between natural and developed areas where important natural functions and features are preserved for all time. Our waters, fields, farms, and forests are essential for our well-being and the health of our environment. CLCF’s land protection projects seek to preserve one or more of the following:

- natural habitat

- shorelines and wetlands

- water quality

- unique scenic landscapes and open space (including farmland and forest land)

- wildlife corridors or connections to other protected lands

- outdoor recreation or education area

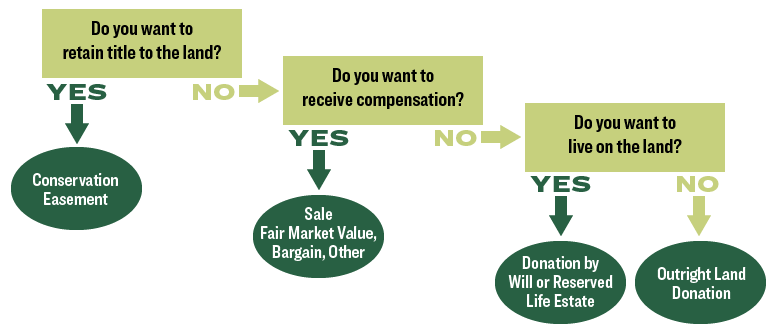

CLCF permanently protects land through fee simple transactions and conservation easements. Arriving at the land protection strategy that is right for your situation takes thought and deliberation.

Which Strategy Is Right For Me?

A Look at the Strategies

We’re Here To Help

Land trusts, like CLCF, are dedicated to helping landowners plan for the protection of their property. We would be honored to talk with you about the vision you have for your property and to discuss in more detail land protection strategies and how they may apply to your particular situation.